MESSAGE FROM THE PRESIDENT

Dear Clients, Shareholders and Stakeholders,

On behalf of our Board of Directors and the Senior Management Team of the organization, I am delighted to present the Annual Report of BHF Rural Bank, Inc.

Year 2023 is a living testament for the Bank that time and again, we have driven our performance towards persistent attainment of bringing optimum value to our external and internal stakeholders.

Strongminded to serve the rural areas, the Bank continuously strived to deliver its developmental objectives by prioritizing incremental growth, standardizing structure, mitigating risks and implementing sound corporate governance.

At the end of 2023, the Bank’s total assets stood at Php 706,061,732.59, total liabilities amounted to Php 272,203,351.59 and equity attributable to shareholders is

Php 433,858,381.00. In addition, the Bank has achieved a net income of Php 24,355,731.38. These figures have solidified our reputation in the industry as a rural bank of choice in Pangasinan and nearby provinces.

On behalf of the Management, allow me to convey my earnest gratitude to all of our employees for their hard work, to our Directors for their guidance, and to our customers for their relentless support. We will extend our best effort to prioritize corporate transformation and be a trailblazer in the field of banking. We will continue to respond to the trust of our stakeholders with the standard business performance and developments and by working hard to bring the best experience possible.

Yours truly,

CORPORATE PROFILE

BHF Rural Bank, Inc. (BHF Bank) was formed in order to bring to the community their financial needs and to be the local rural bank of choice in Pangasinan.

BHF Bank Head Office is currently situated at BHF Bank Building, Mayombo District, Dagupan City with its Branches strategically located in the premier cities and municipalities of Pangasinan and La Union.

BHF Rural Bank, Inc. has seven branches, to wit: (1) Dagupan City Branch (Main), (2) Lingayen Branch, (3) Urdaneta City Branch, (4) Tayug Branch, (5) Mangatarem Branch, (6) Rosario, La Union Branch and (7) Alaminos City Branch.

Today, the Bank continues to upgrade its operating systems and professionalize its ranks in order to provide better services to its clientele and to be at par with Bangko Sentral ng Pilipinas and international banking standards.

BHF Bank continues to dream big and to fulfil its mission to the community and all of its stakeholders.

CORPORATE VISION

“The leading financial institution in Luzon with professional and competent team practicing safe and sound banking, delivering exceptional quality customer service and contributing to the economic growth and welfare of our community.”

CORPORATE MISSION

“Build long-lasting partnership with our customers by being responsive to their needs and exceeding their expectations.”

“Honor its commitment in creating value to our shareholders and to the community we serve.”

“Form a professional and capable team and provide an inspiring work environment.”

CORE VALUES

- Social Responsibility– we care for and contribute to the communities we serve.

- Urgency– we respond to our customers’ needs quickly and effectively.

- Respect– we cherish every individual and treat everyone with respect.

- Efficient– we are entrepreneurial, cost conscious, responsible and accountable

- Honesty and Integrity– We believe honesty is absolute and integrity cannot be compromised.

- Innovation– we encourage creativity and need to constantly innovate to stay relevant in the industry.

- Team– we achieve our goals through the collective and coordinated efforts of our staffs.

FINANCIAL HIGHLIGHTS

Table 1: Financial highlights

(In Thousand Pesos)

|

PARTICULARS |

2023 |

2022 |

2021 |

2020 |

||

|

Profitability |

|

|

|

|

||

|

|

Total Net Interest Income |

48,977 |

48,033 |

47,737 |

53,374 |

|

|

|

Total Non-interest Income |

18,851 |

25,731 |

23,133 |

20,688 |

|

|

|

Total Non-interest Expenses |

64,444 |

54,468 |

50,219 |

43,717 |

|

|

|

Pre-provision Profit |

3,202 |

19,296 |

20,651 |

30,346 |

|

|

|

Allowance for Credit Losses |

(21,528) |

(958) |

(4,756) |

8,339 |

|

|

|

Net Income |

24,355 |

20,005 |

25,408 |

22,007 |

|

|

Selected Balance Sheet Data |

|

|

|

|

|

|

|

|

Liquid Assets |

97,890 |

86,117 |

88,177 |

87,359 |

|

|

|

Gross Loans |

385,620 |

451,053 |

491,690 |

479,544 |

|

|

|

Total Assets |

706,061 |

709,524 |

777,260 |

731,315 |

|

|

|

Deposits |

253,320 |

269,162 |

250,022 |

240,217 |

|

|

|

Bills Payable – DOSRI |

– |

– |

– |

– |

|

|

|

Bills Payable – Banks |

– |

– |

100,000 |

79,600 |

|

|

|

Total Equity |

433,858 |

420,280 |

409,543 |

389,286 |

|

|

Selected Ratios |

|

|

|

|

|

|

|

|

Return on Equity |

5.71% |

4.82% |

6.48% |

6.05% |

|

|

|

Return on Assets |

3.44% |

2.69% |

3.49% |

3.02% |

|

|

|

Capital Adequacy Ratio |

52.83% |

50.21% |

45.6% |

46.78% |

|

|

Per Common Share Data |

|

|

|

|

|

|

|

|

Net Income per Share |

89.19 |

66.68 |

84.69 |

73 |

|

|

|

Book Value |

1,446.19 |

1,400.93 |

1,365.14 |

1,297.62 |

|

|

Others |

|

|

|

|

|

|

|

|

Cash Dividends Declared |

NONE |

NONE |

NONE |

NONE |

|

|

|

Headcount |

|

|

|

|

|

|

|

Officers |

36 |

34 |

36 |

34 |

|

|

|

Staff |

40 |

41 |

42 |

42 |

|

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

OPERATIONS

Despite of the unstable market behavior, the bank took critical decisions in establishing short- term resilience by optimizing its Balance Sheets which resulted in 3% increase in Total Equity. This drive inspired the bank further in establishing exceptional risk management strategies and infrastructures to transition to a more future- proof business model.

Total loans portfolio stood at Php 385,620,744.54 at the end of year 2023. The decrease of 14.51% compared to 2022 were brought about by non performing accounts which were transferred to Real and Other Properties Acquired (ROPA) by the end of the year.

The Bank shall continue to prioritize the underserved market of the country’s financial system as we advocate for financial inclusion and empowerment of the economically challenged group of small entrepreneurs.

FINANCIAL PERFORMANCE REVIEW

As a result of numerous financial turmoil in the country, most markets have caused to behave as erratic. The Bank is not exempted to this scenario as we trail the year of 2023:

Table 2: Revenues and Expenses

|

PARTICULARS |

AMOUNTS |

||

|

INTEREST INCOME |

|

||

|

|

LOANS |

|

54,376,460.81 |

|

|

DFOB |

|

1,091,155.27 |

|

|

SCR |

|

2,808,196.46 |

|

NON-INTEREST INCOME |

18,850,860.89 |

||

|

TOTAL INCOME |

77,126,673.30 |

||

|

|

|

|

|

|

INTEREST EXPENSES |

|

||

|

|

DEPOSITS |

|

9,298,824.23 |

|

|

OTHER IBL |

– |

|

|

NON-INTEREST EXPENSES |

64,444,206.92 |

||

|

PROVISION FOR CREDIT LOSSES |

(181,404.63) |

||

|

INCOME TAX |

|

374,743.00 |

|

|

TOTAL EXPENSES |

73,743,031.15 |

||

|

|

|

|

|

|

NET INCOME |

|

24,355,731.38 |

|

BHF Bank has reported a net income of Php24,355,731.38 in 2023. Net income increased by 22% from 2022. While there was a decrease in Net Interest Income, the Bank was able to reverse a whopping Php15,741,370.65 out of provisioning. This was an attestation of the improving quality of the bank’s loan portfolio.

Operating expenses increased by 5% to Php64.444 Million. The Bank has seen rise in incurred expenses on travelling and fuel, compensation and benefits, utilities expenses and litigation expenses. These expenses were necessary to accomplish all unperformed activities in previous years particularly litigations, marketing, etc.

LENDING

The year 2023 has prompted the Bank to be more rigorous in terms credit underwriting process. This is important for the organization to meet the challenges of an ever-changing market. As a result, our loan portfolio has decreased by Php 65,432,541.45 or 15%. This drive has resulted though to an impressive decrease in the Past Due Ratio from 23.86% in December 2022 to 6.20% by the end of December 2023.

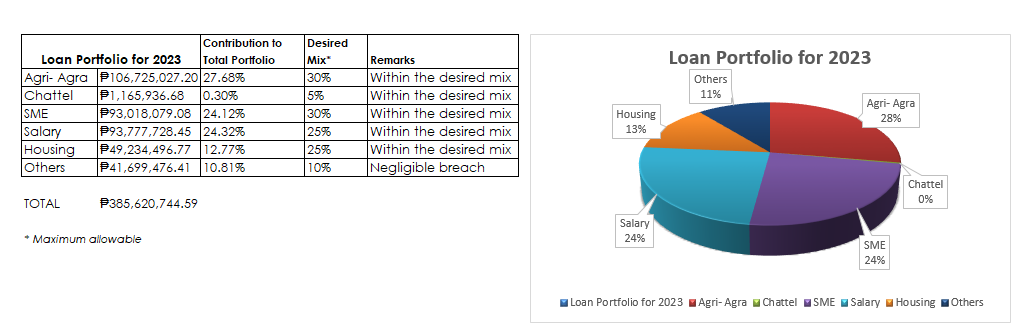

Table 3: Loan Portfolio for the Year Ending 2023

(In Thousand Pesos)

Loans for Agri Agra and Small to Medium Enterprises contribute to 28% and 24% (combined percentage of 52%) respectively to our total loan portfolio. All loan products except from Other Loans (with a negligible variance of less than 1% from the Desired Mix Percentage) are within the range of the desired portfolio mix.

Table 4: Comparative Loan Releases for Selected Products

(In Thousand Pesos)

|

Releases |

2023 |

2022 |

Increase/Decrease |

|

Agri- Agra |

₱43,000,000.00 |

₱47,500,000.00 |

-₱4,500,000.00 |

|

Chattel |

₱300,000.00 |

₱667,000.00 |

-₱367,000.00 |

|

SME |

₱14,600,000.00 |

₱53,035,000.00 |

-₱38,435,000.00 |

|

Salary |

₱47,620,900.00 |

₱51,756,059.00 |

-₱4,135,159.00 |

|

Housing |

₱14,150,000.00 |

₱19,550,000.00 |

-₱5,400,000.00 |

|

Others |

₱30,650,000.00 |

₱770,000.00 |

₱29,880,000.00 |

|

|

|

|

|

|

TOTAL |

₱150,320,900.00 |

₱173,278,059.00 |

-₱22,957,159.00 |

The loan releases had decreased to 13% due to the implementation of a more improved credit underwriting process. This may seem a trade-off from the usual productivity of the Bank, but we’ve seen an increased impact in our bottom- line figures. And the Bank is still expected to benefit from this in the coming years.

LIQUIDITY MANAGEMENT

The Bank’s average minimum liquidity ratio (MLR) throughout the year – 37.36%, comfortably sits above the minimum requirement. Liquidity has become one of the Bank’s main priorities now more than ever.

The Bank has satisfactorily maintained enough funding source and liquidity. The Bank was able to consistently attain at least 20% MLR.

Table 5: Other liquidity ratios as of December 2023:

|

Particulars |

BHF Bank |

Industry |

|

Ave. Cash & DFOB to Deposits ratio |

34.46% |

25.35% |

|

Ave. Loans to Deposits ratio |

152.23% |

85.50% |

BHF Bank has consistently maintained excellent liquidity position throughout the years. The Bank is confident that it has enough cash to support unexpected heavy withdrawals or any other liquidity stress scenario.

The Bank has not relied greatly on deposits and all other interest-bearing liabilities were well matched against cash inflows of the Bank. Deposits were mostly long-term in nature, hence, with higher interest rates.

EQUITY

Total equity has increased by Php13.578 Million or by 3.2% bringing the total equity to Php 433.858 Million from Php420.280 Million in 2022. The Bank’s Capital Adequacy Ratio (CAR) remained excellent at 52.33%. The Bank’s CAR sits comfortably above the industry ratio of 18.77% or 2.79 times higher than the industry ratio.

The Bank managed to achieve an impressive 5.71% ROE which is 0.89% higher than 2022. Average equity for the year was Php413.605,269.29 Million.

RISK MANAGEMENT

Under existing rules and regulations, the Bank’s Risk Management System is supervised by the Board of Directors through the President and the Chief Operating Officer of the Bank. The Bank acknowledges that the business risks and risk management and risk mitigation are necessary to sustain long-term success. The Bank has improved its ranks and hired services of competent professionals as advisers. Through the years, the Bank has ensured effective risk management by ensuring that necessary measures and internal controls are in place and complied by all people in the Bank.

The Bank’s risk management, as it has always been is based on what the Bank is willing to bear for a given benefit. The Bank’s corporate/corporate governance structure is in line with the risks the Bank faces and will be facing for the foreseeable future. Senior Officer and Department Heads are designated as risk officers of their respective units and shall report to the President or to the MANCOM all risk related matters on a timely manner. The following are the Unit Heads designated as risk officers of their Department:

Melchor G. Noynay Jr., COO (and Branch Heads) – Branches/Operations

Ranjo B. Robosa, MIS Head – MIS/IT

Michelle C. Prestousa, Credit Head – Credit

Rowena F. Estrada, HRD Head – HRD

Jose M. Maer, AMO – ROPA/Assets

Mark Louie A. Cabrito, RMU Head – Remedial

Cecilia A. Cariňo, Comptroller – Accounting and Finance

Elmer N. Peralta, DRU Officer – Document Review

Fritzi Kay B. Simbulan, CCO – Compliance

Ma. Louela L. Paragas, Internal Audit Head – Internal Audit

In order to ensure that the institution shall not serve as a channel for any illegal activities, the Bank has established controls on detection of fictitious accounts and fraudulent transactions. The Bank shall close any account which has been subsequently discovered as assigned to a fictitious name or person. In addition, the Branch Operations Officer shall report such closure to the Chief Compliance for AML reporting purpose (Suspicious Transaction Report-STR).

The Internal Audit and the Compliance Office continuously assess the effectiveness and compliance with the policies, procedures and controls set under the Risk Management System of the Bank. The Chief Compliance Officer (CCO) shall likewise act as the Anti-Money Laundering (AML) Officer of the Bank.

BHF Bank’s primary direction is to maintain its resiliency and relevance in the rural banking industry by maintaining excellent capital ratios, liquidity ratios and profit ratios and all other basic financial ratios.

RISK APPETITE AND STRATEGIES

The Bank operates at a MODERATE business risk appetite. Both internal and external factors shall be mitigated by the following strategies as stipulated in our Strategic Plans:

- Periodic and more stringent compliance monitoring to attain zero instance of non- compliance and penalties to all BSP regulations;

- Constant conduct of niche marketing and bring the our products to the market to cushion the impact of growing number of direct competitors backed by commercial/universal banks. This is backed up with strategies to increase our loan portfolio and low cost deposits;

- Intensive collection efforts to align with the industry- prescribed percentage of past due accounts (or better);

- Continuously review and calibrate the credit underwriting process;

- Aggressive disposal efforts to convert ROPAs to funds;

- Introduction of viable retention plans to address concerns on employee attrition;

- Offer end to end banking solutions to stay relevant in the market.

Finally, the Bank has identified and implemented credit risk management strategies which are intrinsic to all its products and activities. We will ensure that the inherent risks of products and decisions which are unfamiliar to the organization shall be subjected to objective and sufficient controls and check points before being implemented. Thus, establishing an appropriate risk management environment.

CORPORATE GOVERNANCE AND STRUCTURE

BHF Bank is committed to ensuring that the institution complies with regulatory provisions and practices safe and sound banking which is necessary in achieving the Bank’s goals and objectives.

With good governance, the bank shall raise investor confidence, achieve highly sustained growth, and maximize the value of the company to its shareholders.

The Board of Directors, Senior Management of BHF Bank down to the staffs adhere to the highest standards, principles and practices of good governance. It hails from the regime of adhering to the Fairness, Accountability and Transparency in the conduct of its business, dealing fairly with clients, investors and stakeholders as well as the general public it serves. To achieve good governance, the Bank enforces compliance culture and discipline and self-assessment in its policies, processes and procedures.

CORPORATE GOVERNANCE STRUCTURE

Table 6: Directors & Stockholdings

|

Name |

Type |

No. of Shares (Direct Shares) |

Percentage |

|

Dr. Armando B. Bonifacio |

Executive |

48,157 |

16.05233333% |

|

Remigio B. Bonifacio, Jr. |

Non-Executive |

42,792 |

14.26400000% |

|

Emelda B. Mendoza |

Non-Executive |

42,792 |

14.26400000% |

|

Cherie B. Estrada |

Executive |

42,791 |

14.26366667% |

|

Rosemarie B. Bonifacio |

Non-Executive |

42,792 |

14.26400000% |

|

Reynaldo B. Bonifacio |

Non-Executive |

42,791 |

14.26366667% |

|

Remigio S. Bonifacio III |

Executive |

1 |

0.00033333% |

|

Laurence C. Tueres |

Non-Executive |

3 |

0.00100000% |

|

Manolito L. Movida |

Independent |

1 |

0.00033333% |

|

Michael D. Armas |

Independent |

1 |

0.00033333% |

|

Ceres V. Palisoc |

Independent |

1 |

0.00033333% |

|

TOTAL |

|

262,122 |

87.374% |

BOARD OF DIRECTORS

The Board of Directors carries the responsibility of ensuring that good governance principles are carried throughout the Bank and is responsible for the overall leadership and direction of the Bank to ensure long-term success by satisfying the clients’ needs while upholding its reputation.

The main mandate of the Board is to implement strategic plans, risk management strategies and good governance strategies of the Bank. The Board is likewise responsible in strategizing the corporate structure of the Bank, developing and implementing plan of succession, approving major strategies and policies and overseeing all major risk-taking activities.

The Board continuously and periodically reviews practices, policies and procedures of the Bank.

The Bank’s Board of Directors is currently composed of eleven (11) directors with a balance of skills, knowledge and experience among its members to perform their decision-making responsibilities. All members are at least with bachelor’s degree – most are in the fields of Commerce.

The members of the Board are elected by the stockholders during annual stockholders meeting with each member holding an office for one year. Each member of the Board is subject to the qualifications set by the Bangko Sentral ng Pilipinas and other existing laws and regulations of the land. Independent Directors are non-executive directors and are independent of Management.

Directors shall serve for one (1) year and until their successors are elected and qualified. A director shall hold office for such period unless before his term expires, he resigns, is removed from office, become incapacitated for reason of sickness or death, or otherwise disqualified by law or by the Bangko Sentral or by removal from office by a vote of the stockholders representing at least two-thirds (2/3) of the outstanding capital stock in the manner provided for in the Corporation Code of the Philippines.

Any vacancy occurring in the Board of Directors other than by removal by stockholders or by expiration of term, may be filled by the vote of at least a majority of the remaining directors, if still constituting a quorum; otherwise said vacancy must be filled by stockholders in a regular or special meeting called for purpose. A director so selected to fill a vacancy shall serve only the unexpired term of his predecessor in office.

DUTIES AND RESPONSIBILITIES OF THE CHAIRMAN OF THE BOARD

The roles of the Chairman shall, as much as practicable, be separate to foster an appropriate balance of power, increased accountability and better capacity for independent decision-making by the Board.

- The Chairman of the Board shall provide leadership in the Board. He/She shall ensure effective functioning of the Board, including maintaining a relationship of trust with Board members. In addition, the Chairman shall ensure a sound decision making process and he should encourage and promote critical discussions and ensure that dissenting views can be expressed and discussed within the decision-making process.

The Chairman of the Board shall have the following powers and duties:

a) To preside at all meetings of the stockholders and of the Board, and to ensure that the meeting of the Board are held in accordance with the By-Laws or as the Chairman may deem necessary;

b) To supervise the preparation of the agenda of the meeting in coordination with the Corporate Secretary, taking into consideration the suggestions of the President, management and the directors;

c) To maintain qualitative and timely lines of communication and information between the Board and management;

d) To submit an annual report of the operations of the Bank to the stockholders at the annual meeting;

e) To exercise such general supervision as may be necessary to determine whether the resolutions and orders of the Board and of any authorized committee have been carried out by the management; and

f) To exercise such other powers and perform such other duties as the Board may from time to time fix or delegate

DUTIES AND RESPONSIBILITIES OF DIRECTORS

A director of the Bank shall have the following duties and responsibilities:

1) Accept the responsibility for creating and enhancing shareholder value and ensuring the long term success and viability of BHF RURAL BANK, INC.;

2) Devote time and attention necessary to properly discharge his duties and responsibilities as Director;

3) Exercise sound and independent judgment at all times and ensure that personal interest does not bias any Board decision;

4) To act honestly and in good faith, with loyalty and in the best interest of the institution, its stockholders, regardless of the amount of their stockholdings, and other stakeholders such as its depositors, investors, borrowers, other clients and the general public. A director must always act in good faith, with the care which an ordinarily prudent man would exercise under similar circumstances. While a director should always strive to promote the interest of all stockholders, he should also give due regard to the rights and interests of other stakeholders. Before deciding on any matter brought before the BOD, every director should thoroughly evaluate the issues, ask questions and seek clarifications when necessary. A record of Minutes of Meeting shall be maintained where Directors are expected to actively interact in discussing certain agenda or issue prior to any action to be taken. Actions to be taken are reduced to a resolution.

5) Directors should actively participate and exercise objective independent judgment on corporate affairs requiring the decision or approval of such Board.

6) Understand and internalize the core values of BHF RURAL BANK, INC.;

7) Maintain a good working understanding of the various businesses of BHF RURAL BANK, INC., the risks attendant to those businesses, and the risk measurement and control systems appropriate for such businesses, understand the competitive forces affecting BHF RURAL BANK, INC. and the key strategic performance factors necessary to attain leadership;

8) Maintain a good working knowledge of the statutory and regulatory requirements affecting BHF RURAL BANK, INC., the requirements of the Bangko Sentral ng Pilipinas (BSP), Securities and Exchange Commission, the contents of its Articles of Incorporation and By-laws;

9) Conduct fair business transactions with BHF RURAL BANK, INC. and ensure that personal interest do not conflict with BHF RURAL BANK, INC.’s interests; desist from any transaction where there is such a conflict of interest and any transaction that exploits insider information to generate personal gain;

10) Act with full transparency, fairness, independence and sound judgment; and

11) Observe confidentiality over all sensitive matters taken up by the Board.

QUALIFICATIONS OF DIRECTOR

A director of BHF RURAL BANK, INC. shall have the following qualifications:

At least twenty one (21) years of age at the time of his election or appointment;

- A college degree or its equivalent or adequate competence and understanding of the fundamentals of doing business or membership in good standing in relevant industry, and membership in business or professional organizations or sufficient experience and competence in managing a business to substitute for such formal education;

- Possesses integrity, probity and shall be diligent and assiduous in the performance of his functions;

- Adequate physical health and mental stamina to withstand the rigors and requirements of his duties and responsibilities;

- No potential conflict of time and attention due to competing officerships, directorships, memberships and positions in other corporations or rural banks.

- No disqualifications as provided for in the SEC Code, BSP Circulars and other relevant regulations; and

- Must have attended accredited corporate governance seminar, as required by the BSP and SEC, within a period of six (6) months from date of election, for those elected after 30 June 2003. However, the following are exempted from attending such seminars:

(1) Foreign nationals who have attended corporate governance training covering core topics in the BSP-recommended syllabus and certified by the Corporate Secretary as having been made aware of the general responsibility and specific duties and responsibilities of the board of directors and specific duties and responsibilities of a director prescribed under items “b”, “c” and “d” of Subsection X141.3;

(2) Filipino citizens with recognized stature, influence and reputation in the banking community and whose business practices stand as testimonies to good corporate governance;

(3) Distinguished Filipino and foreign nationals who served as senior officials in central banks and/or financial regulatory agencies, including former Monetary Board members; or

(4) Former Chief Justice of the Philippine Supreme Court.

It shall be the responsibility of the Corporate Secretary to ensure that the director concerned has attended the required seminar.

MEMBERS OF THE BOARD

1. REMIGIO B. BONIFACIO, JR.

Chairman

Filipino, 53 years old

Years Served as Director: 27 years

Mr. Remigio B. Bonifacio, Jr. has been a member of the Board since the inception of the Bank. He is currently the Chairman of the Board. He is a graduate of B.S. in Business Administration from Luzon Colleges. Prior to joining the BHF Bank in 1997, he has been a Director of the BHF Corporation in 1995 and holds the position up to the present. Currently, he is also a Stockholder of BHF Pawnshop. Before his election as Chairman of the Board, he was also a member of the Bank’s Credit Committee. He attended various seminars including corporate governance.

2. ARMANDO B. BONIFACIO

Director / President

Filipino, 56 years old

Years Served as Director: 27 years

He was a member of the Board since the inception of the Bank in 1997 and has been the most active member of the Board being the Chairman and the President since 2006 up to 2017. He has more than 20 years of banking experience and is also currently a stockholder of BHF Pawnshop, BHF Corporation and the BHF Family Plaza, Inc. He attended various seminars on rural banking, corporate governance and anti-money laundering. He was elected as the President of the Rural Bankers Association of the Philippines (RBAP) in 2017 and became the Chairman of the Rural Bankers Research and Development Foundation, Inc. (RBRDFI) in 2018.

Dr. Bonifacio took-up B.S. Medical Technology (1988) at the University of Sto. Tomas and Doctor of Medicine (1992) at the De La Salle University.

3. EMELDA B. MENDOZA

Director

Filipino, 58 years old

Years Served as Director: 18 years

Ms. Emelda B. Mendoza was elected as the Chairman of the Board in July 2018. She was a Director of the Bank since 2008. She currently has interests and holds other positions in other entities. She is a Consultant of BHF Pawnshop, Director of BHF Corporation, General Manager and owner of Bloomfield Hotel, Treasurer of Outlook Drive Residences, Inc. and the President of R&E Premier Land Corporation.

She is a graduate of Fine Arts at the University of the Philippines. She attended various seminars including corporate governance and Anti-Money Laundering.

4. ROSEMARIE B.BONIFACIO

Director

Filipino, 52 years old

Years Served as Director: 27 years

Ms. Rosemarie B. Bonifacio has been a member of the Board since the inception of the Bank. She earned her Master’s Degree in Entrepreneurship from Asian Institute of Management. Currently, she is a Director of BHF Corporation and a Stockholder of BHF Pawnshop, Inc. She attended various seminars including corporate governance.

5. CHERIE B. ESTRADA

Director / Treasurer

Filipino, 60 years old

Years Served as Director: 18 years

Ms. Cherie B. Estrada is the Treasurer of the Bank. She is a graduate of Maryknoll College with a degree in Business Administration. She is a long time Director of the Bank. She is also a Director of BHF Corporation and a Stockholder of BHF Pawnshop. She is also a stockholder of CB Mall.

6. REYNALDO B. BONIFACIO

Director

Filipino, 63 years old

Years Served as Director: 18 years

Mr. Reynaldo B. Bonifacio is a graduate of Business Management from the Ateneo De Manila University. He is a long time director of the Bank. He is very active in the business world as he is also the long-time Executive Vice-President of BHF Corporation and the Chairman and Chief Executive Officer of BHF Prime Group Corporation while also a Stockholder of BHF Pawnshop.

He attended various seminars including Corporate Governance and Risk Management for Rural Banks.

7. REMIGIO S. BONIFACIO III

Director

Filipino, 38 years old

Years Served as Director: 3 years

Mr. Remigio S. Bonifacio III is a graduate of Humanities Specialized in Industrial Economics from the University of Asia and the Pacific. He was one of the newest members of the Board. Aside from being a Director of the Bank, he is also a Director of BHF Prime Group Corporation and BLOC 7202 Ventures, Inc.

8. MICHAEL D. ARMAS

Independent Director

Filipino, 48 years old

Years Served as Director: 3 years

Mr. Michael D. Armas is a newly elected Director of the Bank. Prior to joining the Bank, he was employed in Bank of Commerce in 2003 and BDO in 2007 as Bank Officer. He also served as College Dean at the Virgen Milagrosa University.

Mr. Armas is a graduate of Accountancy at Saint Louis University. He then completed his Master in Business Administration at the Virgen Milagrosa University. He then took-up his Doctor of Philosophy in Management at SLU. He is a CPA, a Licensed Real Estate Appraiser and a Licensed Professional Teacher.

9. LAURENCE C. TUERES

Independent Director

Filipino, 55 years old

Years Served as Director: 11 years

Mr. Laurence C. Tueres is a Political Science graduate at San Sebastian College. He started his banking profession in 1990 when hired as an Account Officer of Planters Development Bank. He was hired as Manager by Philippine Business Bank in 1997. After his banking stint, he was hired as Senior Manager by Digitel Telecommunications from 1999 to 2005. On May 2005, Mr. Tueres started the GSL Trademart Corporation and assumed as the President.

10. MANOLITO L. MOVIDA

Independent Director

Filipino, 68 years old

Years Served as Director: 4 years

Mr. Movida has 40 years of banking experience working in some of the largest banks in the country. Mr. Movida first tried his luck in banking in 1978 when he was hired as a clerk in Philippine National Bank. He was able to rise from the ranks and held multiple key positions such as, Comptroller, Assistant Manager, Branch Manager, and Internal Auditor. He also worked as Branch Head at United Overseas Bank and in 2006, he was hired as Branch Manager in BDO until he retired in 2017 as Assistant Vice President (AVP).

11. CERES V. PALISOC

Independent Director

Filipino, 65 years old

Years Served as Director: 2 years

Ms. Palisoc is the newest member of the Board and has graduated from the University of Santo Tomas in 1979 with the degree of BS Business Administration. She has worked in International Corporate Bank and Bank of Commerce.

12. JASON MEJIA

Corporate Secretary

Filipino, 54 years old

Atty. Jason Mejia was appointed as the Corporate Secretary of the Bank. He earned his Bachelor of Laws degree from Lyceum of the Philippines.

The members of the Board actively participate in the governance of the Bank. Executive Directors are very much involved in the day-to-day operations while independent directors contribute in the check-and-balance, i.e. self assessment functions.

BOARD COMMITTEES

There are three (3) committees helping the Board in discharging its duties and responsibilities in running the Bank. Each committee operates and conducts its business under procedures and guidelines duly approved by the Board and according to the rules set by the BSP. Below are the compositions of the committees.

1. CREDIT COMMITTEE

The Credit Committee’s primary responsibility is to oversee the review, extension and management of credit/loans being undertaken by the Bank. The Credit Committee recommends policies, procedures, and guidelines to the Board of Directors which will reduce credit risk, enhance credit facilities, quality loans, competitiveness and profitability for the Bank.

The Credit Committee oversees the implementation of credit policies, procedures and guidelines and recommends enhancements from time to time. The Credit Committee approves loan within its approving authority limit and recommends approval of loans that requires Board level approvals.

Chairman: Dr. Armando B. Bonifacio

Members: Cherie B. Estrada

Remigio S. Bonifacio III

2. AUDIT COMMITTEE

The Audit Committee of the Bank provides oversight of the institution’s financial reporting, internal controls, as well as internal and external audit functions. The Audit Committee is primarily responsible for overseeing senior management in the establishment and maintaining of an adequate, effective and efficient internal control framework. It ensures that systems and processes are designed to provide assurance in areas including reporting, monitoring compliance with laws, regulations and internal policies, efficiency and effectiveness of operations, and safeguarding of assets.

The Audit Committee is accountable for setting up the bank’s internal audit department.

Chairman: Manolito L. Movida

Members: Michael D. Armas

Ceres V. Palisoc

3. RPT COMMITTEE

The RPT Committee shall assist the Board in ensuring that:

- Transactions with related parties are handled in a sound and prudent manner, with integrity and in compliance with applicable laws and regulations to protect the interest of depositors, creditors and other stakeholders; and

- RPTs are conducted on an arm’s length

The RPT Committee shall meet on a quarterly basis or whenever necessary to discuss and agree on matters to be endorsed to the Board of Directors for approval and confirmation. The Committee shall have the authority to investigate any matter within its duties and responsibilities under the law, rules, circulars, memoranda and/or this charter, full access to and cooperation from management and other units of the Bank, with full discretion to invite any officer or employee to its meetings.

Chairman: Michael D. Armas

Members: Manolito L. Movida

Laurence C. Tueres

Table 7: Directors’ Attendance

|

Name |

Board Meeting |

Credit Committee |

RPT Committee |

Audit Committee |

||||

|

Number of Meetings |

15 |

Number of Meetings |

18 |

Number of Meetings |

12 |

Number of Meetings |

5 |

|

|

Dr. Armando B. Bonifacio |

15 |

100% |

18 |

100% |

|

|

|

|

|

Remigio B. Bonifacio, Jr. |

15 |

100% |

|

|

|

|

|

|

|

Emelda B. Mendoza |

15 |

100% |

|

|

|

|

|

|

|

Cherie B. Estrada |

15 |

100% |

18 |

100% |

|

|

|

|

|

Rosemarie B. Bonifacio |

15 |

100% |

|

|

|

|

|

|

|

Reynaldo B. Bonifacio |

15 |

100% |

|

|

|

|

|

|

|

Ceres V. Palisoc |

13 |

87% |

|

|

|

|

5 |

100% |

|

Remigio S. Bonifacio III |

15 |

100% |

18 |

100% |

|

|

|

|

|

Laurence C. Tueres |

13 |

87% |

|

|

12 |

100% |

|

|

|

Manolito L. Movida |

13 |

87% |

|

|

12 |

100% |

5 |

100% |

|

Michael D. Armas |

13 |

87% |

|

|

12 |

100% |

5 |

100% |

EXECUTIVE OFFICERS AND SENIOR MANAGEMENT

The following comprise the Executive Officers and Senior Management of BHF Rural Bank, Inc. They are generally the department heads and in- charge of the bank’s daily operations.

Table 8: Executive Officers and Senior Management

|

BHF Rural Bank Officers |

Department |

Position Title |

|

Dr. Armando B. Bonifacio |

Executive |

President |

|

Melchor G. Noynay Jr. |

Operations |

Chief Operating Officer |

|

Fritzi Kay B. Simbulan |

Compliance |

Chief Compliance Officer |

|

Ranjo B. Robosa |

Management Information System |

MIS Head |

|

Michelle C. Prestousa |

Credit |

Credit Head |

|

Rowena F. Estrada |

Human Resources |

Human Resources Head |

|

Jose M. Maer |

Asset Management |

Asset Management Officer |

|

Mark Louie A. Cabrito |

Remedial Management |

Remedial Management Unit Head |

|

Cecilia A. Cariňo |

Accounting |

Comptroller |

|

Elmer N. Peralta |

Document Review |

Document Review Unit Officer |

|

Ma. Louela L. Paragas |

Internal Audit |

Internal Audit Head |

PERFORMANCE ASSESSMENT AND REMUNERATION POLICY

The Bank assesses the performance of all Directors and Senior Officers as well as the Board Committees on a yearly basis. The Bank through the Board of Directors evaluates annually each director’s qualifications, personal attributes, functions and credit dealings with the Bank, meetings and trainings.

The Board of Directors ensures that each Director meets all the qualifications and none of the disqualifications as a Director of a Bank and that each Director assigned to a Committee has the necessary qualifications. The Board of Directors requires that all directors meet all qualifications set by the BSP.

The Board of Directors requires each Director to be active in the performance of his or her duties and must demonstrate unbiased opinions and decisions concerning the Bank.

The Bank believes that regular assessment of the Board and its members provides a chance to reflect on and assess its areas of strength and weaknesses, helps the Board itself in clarifying and defining the overall standard of performance it requires from the Board and encourages all Directors to reflect on what the Board has accomplished so far.

To further equip all directors in performing their decision-making functions, all Directors are required to undergo necessary training to keep them updated of the ever-changing practices, policies and guidelines of safe and sound banking.

All Directors do not receive any salary, except for the President. Each director is given per diem for each meeting attended. Compensation for the President and any other increase or changes shall be upon the pre-approval by the Board.

For key positions (including senior posts), the Bank has established a procedure aimed at emphasizing the ongoing deficiencies in the performance of all employees and provide timely support and coaching in helping them improve their performance. At BHF Rural Bank, we place high importance in identifying, communicating and improving below standard performance.

Human Resources Department render advisory and oversight services to Managers about the policy guidelines on job evaluation, the process to undertake, and the responsibilities of each unit as well as the standard forms and agreed timeline. Managers will evaluate the jobs within their units, accomplish the forms and comply with the timeline. HR will review the submitted job evaluations and make the necessary recommendations to the Management Committee. This to ensure that the Bank is provided with sound operational independence and to avoid distortion on remuneration structure across all ranks.

ORIENTATION AND EDUCATION PROGRAM

The Bank is committed to consistently deliver various products and services in a timely and accurate manner, through a team of highly motivated professionals who are compassionate and caring. This will be supported by state-of-the-art facilities and equipment, clear and well-defined processes, and excellent education and training programs.

Orientation and seminars on Corporate Governance are mandatory for all Directors. Other related training include orientation and refresher courses on Anti- Money Laundering, bank operations, loans processing, accounting, credit investigation from accredited providers.

Hence, it is our policy through the Human Resources Department to provide, whenever feasible and possible, training and development opportunities to its employees so that they may be able to achieve the optimum level of efficiency in production as well as satisfaction and fulfillment that comes with the working surroundings conducive to fostering excellence, professional work ethics, optimum productivity, rewards and recognition of a job well done.

RETIREMENT AND SUCCESSION POLICY

BHF Rural Bank sincerely values the services rendered by its employees and their selfless dedication and commitment in building their career in the organization. Cognizant of the valuable contribution of its employees, the Bank, therefore, establishes and adopts this retirement plan designed to provide a premium benefit to retiring employees

The Bank has an established Succession Matrix in place and is supported by collaborative partnerships with departments to plan, anticipate and respond in a cost- effective way to changes and priorities in succession management efforts.

RELATED PARTY TRANSACTIONS

BHF Bank recognizes that reputation is its most valuable asset, hence, observes a high standard of integrity in dealing with the public. The board of directors leads in establishing the tone of good governance from the top. The Board ensures that all Related Party Transactions (RPT) are conducted on an arm’s length and in accordance with regulatory requirements.

The Board, through the RPT Committee, evaluates proposed related party transactions by considering the nature of the transactions and the right pricing mechanisms applicable for the specific nature of transaction. It is important to avoid conflict of interest, as such, Directors who have direct or indirect interest on the related party transaction shall be excluded in the approval process.

Material Related Party transactions for the year include loan(s) extended to officers of the Bank:

|

Name of DOSRI |

Amount |

Remarks |

|

Chiney E. Viloria |

Php 8,000.00 |

Purchase of transportation equipment |

SELF-ASSESSMENT FUNCTIONS

The self-assessment functions of the Bank are the Internal Audit and the Compliance Office. While the Internal Audit reports to the Audit Committee, the Compliance Office reports directly to the Board.

1. INTERNAL AUDIT

Head: Ma. Louela L. Paragas

The Internal Audit encourages and fosters compliance and discipline to all personnel of the Bank by conducting process, financial statement and transactions audit.

The Internal audit is committed to add value to the bank by contributing to the improvement of operational efficiency, risk management and internal control through independent and objective assurance and consulting activities. It uses a systematic and disciplined approached to evaluate and improve the effectiveness of risk management, control and governance process through the implementation of risk-based audit. The Internal Audit reports to the Audit Committee.

2. COMPLIANCE OFFICE

Head: Fritzi Kay B. Simbulan

The Compliance Office is tasked to manage compliance processes. It is headed by the Chief Compliance Officer. The Compliance Office has the ability and authority to express and disclose compliance findings to the Board to whom it reports. It shall also have the authority to investigate any breaches or possible breaches to the compliance policy of the Bank.

The Compliance Office has ready access to information necessary to carry-out compliance responsibilities.

DIVIDEND POLICY

The Bank has not declared nor paid any form of dividend during 2023. Declaration of dividends is subject to existing laws and Bangko Sentral rules and regulations.

Stockholders have the right to receive dividends subject to the discretion of the Board. However, the BSP may direct BHF RURAL BANK, INC. to declare dividends when its retained earnings is in excess of 100% of its paid-in capital stock, except:

a) when justified by definite corporate expansion projects or programs approved by the Board;

b) when the BHF RURAL BANK, INC. is prohibited under any loan agreement with any financial institution or creditor, whether local or foreign, from declaring dividends without its consent, and such consent has not been secured;

c) when it can be clearly shown that such retention is necessary under special circumstances obtaining in the BHF RURAL BANK, INC., such as when there is a need for a special reserve for probable contingencies or when the increase in capitalization application has not been approved or still subject to filing of application for increase in capitalization.

CORPORATE SOCIAL RESPONSIBILITY INITIATIVES

The following photos are taken from our joint CSR initiatives with our constant partner, Rotary Club through the Bank’s President, Dr. Armando B. Bonifacio:

Distribution of Relief Goods to the Typhoon- Affected Residents

CONSUMER PROTECTION

BHF Rural Bank, Inc. recognizes the importance of customer protection in its financial dealings with clients. It fully supports the policy of the State and that of the Bangko Sentral Ng Pilipinas (BSP) to protect the interest of the consumers, promote their welfare and to establish standards of conduct for the banking industry. Further, the Bank believes in the principle that the consumer is the life-blood of the Bank and for that reason, only the best services should be accorded to them.

For over two (2) decades since it was given authority to conduct banking services by the BSP, the Bank has shown concern and fairness to its clients whether small or big. It treats clients with utmost courtesy and committed to maintain their respect, trust and confidence.

The Board of Directors has the ultimate responsibility for the level of customer risk assumed by the Bank. Accordingly, the Board approves the Bank’s overall business strategies and significant policies, including those related to managing and taking customer risks. The Board provides clear guidance, develops and maintains sound customer protection risk management.

The Senior Management is tasked to implement programs to manage the customer compliance risks associated with the Bank’s business model. The Senior Management establishes and communicates strong awareness of, and need for, effective consumer protection risk controls and high ethical standards.

The Bank measures and analyses customer risks based on the frequency and severity of the risks. As adherence to consumer protection, the Bank sees to it that rights of clients are protected. The clients must have the right to information, right to choose, right to redress, right to education.

Right to information. The Bank provides clear and honest advertisement and promotion of its products and services. Product features, terms and conditions, benefits and even disadvantages are explained to clients so they can decide based on informed personal choice and guide them in their dealings with the Bank.

Right to choose. The Bank allows its clients to choose the type of deposits, loans and other services at competitive rates with an assurance of providing superb services.

Right to redress. BHF Rural Bank, Inc. acknowledges few instances of poor services extended to customers, such as; errors or mistakes committed by its personnel. In this regard, the Bank rectifies them and extends sincere apologies to the clients and refunds, pays or reimburses excess collection of loans, under payment of interest on deposits, among others.

Right to education. BHF Rural Bank, Inc. adequately educates its customers pertaining to features, terms, systems and procedures, and inherent risks of bank products and services, and his responsibilities as well.

The Bank has established its own policies to strengthen consumer protection especially on the disclosure and transparency, conflict of interest, protection of client information, fair treatment of customers, effective recourse, and consumer awareness.

Branch Operating Officers (BOO) of each of the BHF Bank branches shall act as Customer Assistance Officer (CAO) of their respective branches. All clients are free to approach the CAO of the Branches for assistance, concerns, complaints and queries regarding the products, services and their other transactions with the Bank. Suggestion boxes are available in the Branches.

Contact numbers of the Branches are posted in the Branch and in the website which can be called by clients during banking hours.

The Board of Directors has appointed the Audit Committee to supervise the consumer protection risk management system and the senior management to report on any consumer complaints. The Chief Compliance Officer and the Internal Auditor is likewise mandated to report on the assessment of the status of customer complaints and the effectiveness and efficiency of the existing policies, procedures and controls related to consumer protection.

SUSTAINABLE FINANCE FRAMEWORK

BHF Bank shall seek to pursue sustainable and resilient growth by incorporating environmentally and socially responsible business decisions in the way the Bank operates. The Bank shall embed sustainability principles in all of its operations, goals, business decisions as well as product creation and granting.

BHF Bank’s Commitment to Environmental and Social Responsibility:

- We commit to balancing economic success with environmental and social responsibility.

- We identify and address the environmental and social impacts of our business activities.

- We foster business that enables sustainable growth.

- We are guided by internationally recognized principles and standards.

- We ensure that our sustainability strategy is firmly grounded in robust governance, policies and processes.

Sustainable finance is broadly defined as any form of financial product/service that promotes positive environmental and/or social purposes while contributing to the achievement of the government. BHF RURAL BANK, INC. enumerates and explains the guiding principles for the classification of economic activities as environmentally and/or socially sustainable projects.

Principles for Environmental Sustainability

- Climate change mitigation and adaptation: Economic activities enabling, directly or indirectly, a substantial reduction of Greenhouse gas (GHG) emissions and/or increase of energy efficiency. Measures adapting to acute and chronic physical risks caused or intensified by climate change.

- Protection, restoration and promotion of natural resources and healthy ecosystems: a. Protection of marine and terrestrial [living] resources including water, critical and high-carbon stock ecosystems, and other primary resources. b. Restoration of biodiversity and ecosystems. c. Pollution protection and control and general reduction of resource use.

- Prevention of waste and promotion of recycling and reuse of material.

Principles for Social Sustainability

- Respect for human rights: Respect for, protection and enablement of basic human rights, e.g. food provision, labor protection.

- Enabling living conditions: Access to affordable housing and infrastructure for transportation, Information and Communication Technology (ICT), and energy provision.

- Access to essential services: Inclusive access to health, education, and financial services.

Under this framework, any financing (including but not limited to asset-based lending, corporate and individual level lending) can be classified as sustainable finance. BHF RURAL BANK, INC. defines three parameters based on which a transaction can be classified:

- Use of Proceeds

- Company or Customer’s profile

- Financial Product

If one of the parameters contributes to the achievement of the national government purposes and is in line with BHF RURAL BANK, INC.’s principles for environmental and social sustainability outlined above, a transaction can be classified as sustainable finance.

INITIATIVES SUPPORTING SUSTAINABLE FINANCE FRAMEWORK

Objective # 3 – Good Health and Well-being

Photos from the annual BHF Rural Bank Teambuilding held at Punta Riviera, Bolinao, Pangasinan last June 4, 2023.

Photos from the Yearend Celebration with the theme: Selebrasyong Pinoy. Held at Pedritos in Dagupan City last December 8, 2023.

Ensuring healthy and balanced well-being entails a strong commitment. At BHF Rural Bank, we firmly believe that its benefits outweigh the costs. Healthy people are the foundation for healthy organization, which then turn to a healthy economy.

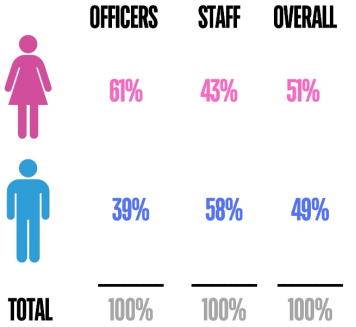

Objective # 5 – Gender Equality & Objective # 10 – Reduced Inequalities

At BHF Rural Bank, we understand that advancing gender equality is not merely a sustainability imperative but a competitive advantage. This is a clearly manifested in the manpower mix of the Bank:

The Bank shall continuously strive for gender- balanced representation at all levels, including the leadership positions. We shall carry on promoting gender diversity to encourage better grasp of the diverse customer profiles. This shall then lead towards a more creative and innovative workforce.

Objective # 8 – Decent Work and Economic Growth

BHF Rural Bank, through its undying effort to promote inclusive and sustainable economic growth and employment has designed the Salary Standardization Framework towards Quarter 4 of 2023. The Framework is set to effect on January 1, 2024. Through the Salary Standardization Framework, the employees of BHF Rural Bank have been encouraged to be more motivated and perform better. We aim to attract and retain talents in the Bank through our competitive and efficient pay structure.

CORPORATE INFORMATION

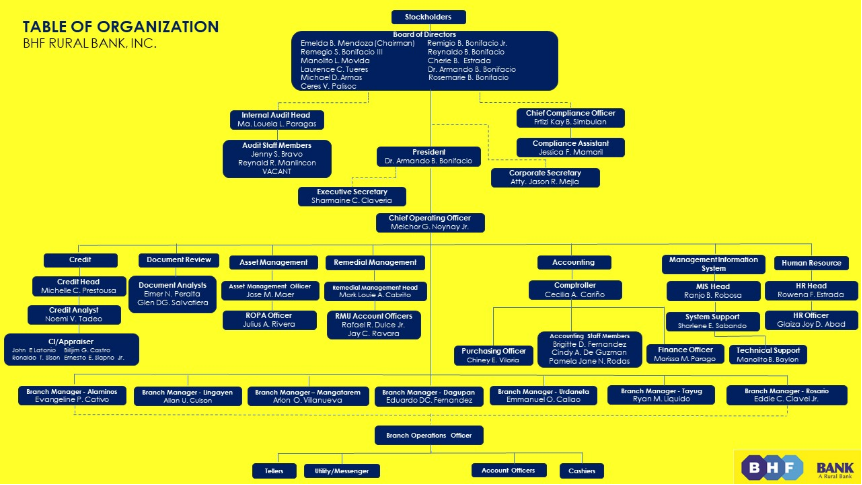

ORGANIZATIONAL CHART

PRODUCTS AND SERVICES

BHF Rural Bank, Inc. offers loans and deposits that suit the needs of the locale it caters.

Loans:

Agrarian Reform Loans – This refers to loans granted to agrarian reform beneficiaries for agricultural and agrarian reform purposes.

Other Agricultural Credit Loans – This refers to loans granted to the Agricultural Sector Other than “1” above.

Agri-Agra loans were mainly:

- Tunnel Vent Piggery/Poultry Loan Program (TVP) – which caters poultryand piggery contract growers who are granted approvals from reputable poultry and swine integrators for the construction of tunnel ventilated poultry/piggery houses and acquisition of poultry/piggery machinery and equipment for this business venture.

- Farmers, Fishermen, Poultry and Hog raisers, Cattle and Goat raisers who are in need of funds for fish, livestock, rice, corn and vegetables production in the provinces of Pangasinan and La Union and nearby provinces.The program is also available to individuals who wish to buy farm machinery and equipment for improved farm mechanization which is very popular in the country nowadays.

Small & Medium Enterprises Loan – Loans granted to entities involved in business activities within major sectors of the economy of which the loan proceeds is to be used in the improvement and furtherance of its business activities. SME are those entities whose total assets, inclusive of those arising from loans but exclusive of the land on which the particular business entity’s office, plant and equipment are situated must have a value falling under the following categories:

- Small – More than P3 Million to P15 Million

- Medium – More than P15 Million to P100 Million

Housing Loan – this loan product primarily caters clients who are in need of funds for acquisition and/or construction of houses.

Auto/Chattel Loan – This loan helps individuals in the acquisition of motor vehicles/cars. Clients in need of loan may offer their motor vehicle as collateral.

Salary Loans (Unsecured) – This salary-loan product is extended to the Department of Education (DepEd) salaried employees.

Other loans – loans that cannot be classified under the forgoing classifications or which the purpose is for general consumption.

Out-of-territorial loans outside Pangasinan and La Union or main area of operations are granted on a case-to-case basis. Loans of higher amount are likewise catered to clients outside Pangasinan and La Union.

Deposits:

Regular Savings Account – is an interest bearing savings deposit withdrawable upon accomplishment of withdrawal slip and presentation of passbook.

Time Deposit – is an interest bearing deposit with specific maturity date evidenced by a certificate issued by the Bank in the name of the depositor.

Basic Deposit – deposit offered to the public and community-based clients who wish to save and transact money in safe, convenient and hassle-free manner without the burden of having to provide extensive documentary requirements or even deposit maintaining balance.

OFFICES AND BRANCHES

HEAD OFFICE

2F BHF Bank Bldg., Mac Arthur Hi-way, Dagupan City, Pangasinan

(075) 522-9079

DAGUPAN CITY BRANCH

1F BHF Bank Bldg., Mac Arthur Hi-way, Dagupan City, Pangasinan

(075) 529-1833

(075) 529-3307

LINGAYEN BRANCH

BHF Bank Bldg., Avenida Rizal East, Lingayen Pangasinan

(075) 662-0446

(075) 529-2687

URDANETA CITY BRANCH

BHF Bank Bldg., Mc Arthur Hi-Way corner Manuel Roxas St., Urdaneta City, Pangasinan

(075) 568-2292

TAYUG BRANCH

BHF Bldg., Mabini St., Brgy. Poblacion, Tayug, Pangasinan

(075) 636-6804

MANGATAREM BRANCH

Calvo St., Poblacion, Mangatarem, Pangasinan

(075) 632-1295

ROSARIO (LA UNION) BRANCH

BHF Bldg., Barangay Subusub, Rosario, La Union

(072) 687-1122

ALAMINOS CITY BRANCH

BHF Bank Bldg., Quezon Avenue, Alaminos City, Pangasinan

(075) 633-0497

WEBSITE : www.bhfruralbank.com

FACEBOOK PAGE : https://www.facebook.com/bhfbank